Balaji Vaidyanath (@nbalajiv) and Devang Patel - Nafa Asset Managers Private Ltd

The Ministry of Power has proposed amendments to the Electricity Act (2003) - in the form of a draft bill that is pending approval - that will unleash the next set of reforms in the power sector and address some major issues plaguing the sector.

Electricity (Amendment) Bill - major timelines:

- Apr-20: Draft bill circulated to other ministries and to the public for consultation

- Jan-21: Note seeking Cabinet approval was circulated

- Jul-Aug-21: Bill could be introduced in Parliament post Cabinet approval.

Key Proposals:

Cost reflective tariff - to reduce cross-subsidies and replace it with DBT

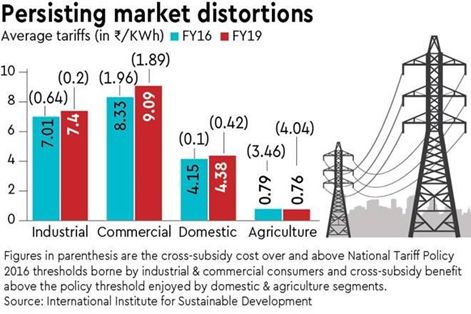

SERCs to determine retail tariffs based on actual cost or fair cost of the supply and without subsidy as against currently being determined based on state's subsidy commitments. Any subsidy is to be provided directly to consumers through DBT. Currently, the cross-subsidy rates on average cost of supply is over 50% in some states vs the max 20% prescribed in the 2016 National Tariff Policy - hurting industrial and commercial users that end up paying very high rates.

National Renewable Energy Policy - to better enforce renewable targets

Central government in consultation with state governments will notify and prescribe minimum renewable and hydro purchase obligation and levy penalties for shortfall. Currently, the targets are prescriptive and left to various State Governments upon their own initiatives. To ensure strict compliance with RPO, penalties to be increased.

Constitution of Electricity Contract Enforcement Authority (ECEA) - to enforce PPAs

The ECEA shall be the adjudicating authority for contract/PPA related disputes as CERC/SERCs are having limited enforcing power. This seeks to address some of the uncertainty caused by actions of some State Governments in the recent past, in attempting to renegotiate executed.

Single committee for selection of ERC/APTEL members - to ensure timely appointments

A common national selection committee will be constituted to select the chairperson and members of APTEL, ERCs and CEA instead of separate and state-wise separate committees that will reduce the time taken to fill up vacancies that takes upto 2 years and hampers ERCs functioning. State power may reduce drastically with representation by rotation in the national committee. Alternatively, state committees may continue to function as standing committees under the national committee.

LDC empowered to oversee payment security - to ensure timely payments to gencos

Regional and State Load Dispatch Centres will be prohibited from dispatch of electricity if adequate payment security is not provided by the distribution licensee which will help reduce the delay in collections by gencos.

Allow distribution sub-contracting - to aid in privatisation

A distribution licensee will be able to authorise a franchise or a distribution sub-licensee to distribute electricity on its behalf with the prior permission of the SERC which will help reduce the entry barriers for private sector participation in distribution.

Why the Need for these changes:

Despite multiple sets of reforms since 2003, the electricity sector is still beset with problems of operational inefficiencies and financial solvency that has a spillover impact on other sectors and manufacturing competitiveness.

Huge and rising subsidies given off-balance sheet:

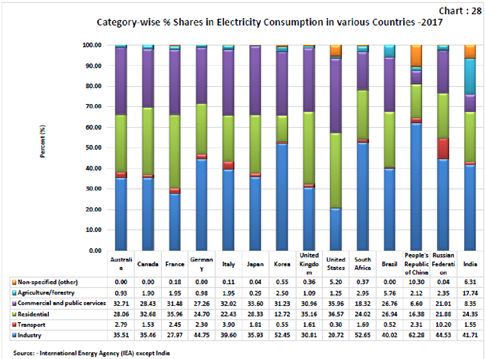

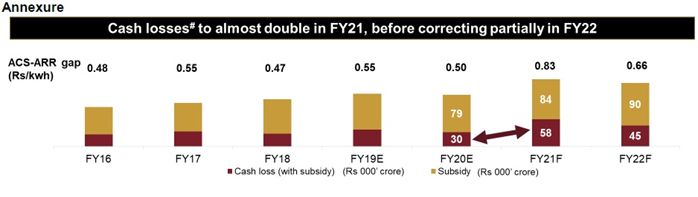

Direct tariff subsidies from state governments in FY19 amounted to Rs 1.1tn - up from 0.75tn in FY16. Cross subsidies are not well reported but estimated to be another 0.75tn. Since there are borrowing limits on state budgets, this burden is shared with discoms and gencos. Powermin estimates the revenue due to Discoms but not collected due to inadequate tariffs (total regulatory asset) at Rs 1.4 tn. Payables to Gencos and Transcos reached 2.26tn as of Mar'19. About 75% of the subsidies is towards agriculture. Share of Agri at 17% of electricity is way higher than other countries. (see exhibit).

Weak discoms and under investments:

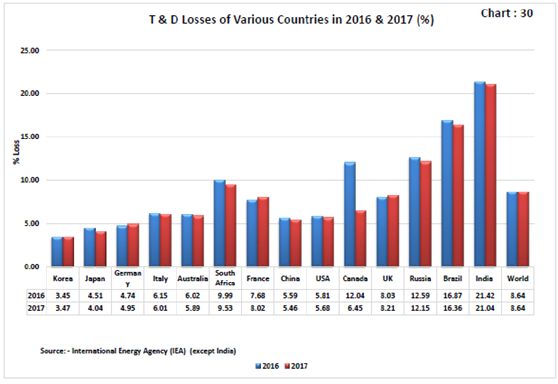

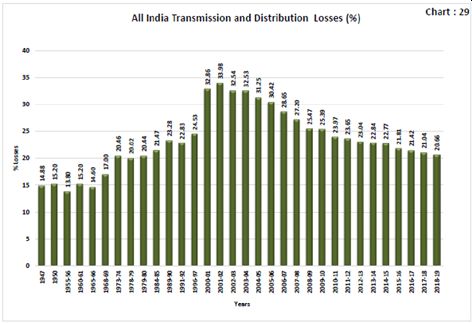

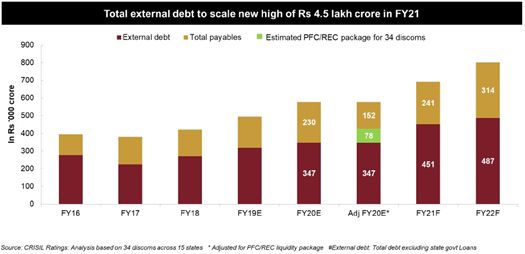

Due to the rise in subsidies, the gap between average cost and realisation remains high. Discoms continue to run up losses and build up their debt. This in turn affects the investments by them. AT&C losses at ~20% are falling but regularly miss reduction targets after every discom bailout and are 2x the world average. (see exhibit)

Impact on other sectors and competitiveness:

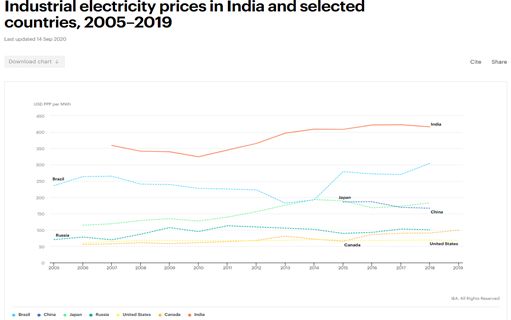

The burden of cross-subsidy borne by industrial and commercial consumers increased from Rs 67,785 crore in FY16 to Rs 75,027 crore in FY19 - their tariffs have gone up over this period. (see exhibit). Stronger companies shift to captive power, leaving the weaker companies to higher tariffs. Industrial tariffs are over 2x of that in China on PPP terms as per IEA. (see exhibit). Discom problems are delaying adoption of distributed generation and net metering.

DBT for better targeting and discipline:

Currently there is no upper limit on subsidised consumption, leading to poor subsidy targeting. Food and fertiliser subsidies have been rationalised through DBT and the same can be achieved in the electricity sector. DBT will lead to better accounting and targeting of subsidies. It may ensure that state governments release the subsidies on a timelier basis. There will be no restrictions on state subsidies but the states will be required to give it upfront through DBT, bringing down the under-collections and improving DISCOM health - leading to better quality supply to industrial and residential consumers.

Implementation Risks:

Despite several attempts and regular bailouts, Discom debt keeps piling up and is estimated to reach 6tn in FY22. Electricity being on the concurrent list has led to slow pace of reforms in the sector. Subsidies are a political hot potato - what give and take happens and how quickly the government can push through the reforms - remains to be seen.

Key Beneficiaries:

- Lenders, mainly REC and PFC

- Equipment manufacturers including meter companies, solar and wind component manufacturers, cable and transformer companies on feeder separation.

- T&D franchisee players like Torrent, Adani, Tata Power

|